👋 Good morning! Hollywood’s chattiest season continues! Hot on the heels of ‘Actors on Actors’ last week, it’s the directors’ turn to dish. Variety’s ‘Directors on Directors’ kicks off today with Denis Villeneuve and Luca Guadagnino swapping stories. Whatever the topic, it’s a masterclass in the making—don’t miss it.

Whether you're a seasoned subscriber or a new arrival, we're thrilled to have you here. Every Monday, Wednesday and Friday, we'll deliver the most important industry scoops directly to your inbox.

🎞 Here’s what’s on the reel today:

“Full Reset Mode” for Marvel

Blockbusters Get a Second Life

Studios Can’t Hide Flops

Netflix Speaks Korean Now

Last Looks: 👀 Bite-sized scoops on developing stories/projects

Video Village: The latest trailers

Call Sheet: The week ahead

Martini Shot 🍸

But first, let’s take a look at what happened at the box office this past weekend!

BOX OFFICE BREAKDOWN

🎟️ ‘Moana’ and ‘Wicked’ keep the party going…

🌊 Moana 2: $26.6M domestic weekend (-48%), $337.5M domestic total, $717M global. Disney's animated hit rules the waves for third straight weekend, now nearing ‘Zootopia's’ $341.2M domestic mark.

🎭 Wicked: Strong $22.5M (-38%) for second place, $359M domestic total, $524.9M global. Surpassed ‘Grease’ to become highest-grossing Broadway adaptation domestically.

🦁 Kraven the Hunter: Dismal $11M opening, $26M global. Sony's Marvel spinoff posts lowest debut in studio's Spider-Verse history with 15% Rotten Tomatoes score and "C" CinemaScore.

⚔️ Gladiator II: $7.8M domestic weekend (-38%), $145.9M domestic total, $398.5M global. Ridley Scott's sequel holding steady in fourth frame.

🧝♂️ The Lord of the Rings: War of the Rohirrim: Weak $4.6M domestic opening, $10.3M global. Anime adaptation fails to connect despite modest $30M budget.

🎅 Red One: $4.48M domestic weekend (-36%), $92.68M domestic total.

🚀 Interstellar: $3.3M domestic weekend (-28%), $199.8M total. IMAX re-release approaching $200M milestone.

🇮🇳 Pushpa: The Rule — Part 2: $1.6M domestic weekend (-67%), $13M domestic total. Sharp drop for Indian action sequel.

🎄 The Best Christmas Pageant Ever: $1.35M domestic weekend (-10%), $36.7M domestic total. Holiday film showing good holds.

🌈 Queer: $791K domestic weekend, $1.9M total. A24's drama expands to 460 theaters.

The Big Picture: The weekend's $87.9M total marks a 13.7% improvement over the same frame last year, though 2024 still lags behind 2023's overall box office. New releases struggled, but the holiday cavalry arrives next week as Disney's 'Mufasa,' and Paramount's 'Sonic the Hedgehog 3' battle for Christmas crowds, followed by Focus Features' 'Nosferatu' remake, A24's 'Babygirl,’ and Searchlight's Bob Dylan biopic 'A Complete Unknown' on December 25.

CLOSEUP

🦸♂️ Sony just had their worst Marvel debut ever…

(Source: Jay Maidment/Sony Pictures via AP)

Kraven the Hunter just stumbled into theaters with an $11M opening weekend—Sony's worst Marvel debut ever, though not the lowest for Marvel overall (that dubious honor belongs to ‘The Marvels’ at $84.5M total). With a $110M budget, this one's leaving a mark on Sony's wallet.

Quick explainer: Sony owns the movie rights to Spider-Man and his related characters (thanks to a deal from 1999), while Disney owns the rest of Marvel. That's why we get two flavors of Marvel movies: Sony's Spider-Verse stuff and Disney's wider Marvel universe. They occasionally play nice and share Spider-Man for Disney's ‘Avengers’ films, but mostly do their own thing.

The superhero slump

Disney/Marvel's struggling to maintain its magic touch, with ‘The Marvels’ becoming their lowest-grossing film ever ($84.5M domestic), ‘Eternals’ falling flat, and several recent shows failing to capture audiences like they used to

Sony's Spider-Man spinoffs can't seem to find their footing—’Madame Web’ ($43.8M total) and ‘Morbius’ ($73.8M total) both bombed, and now ‘Kraven the Hunter's’ joining their troubled club

Even DC's heavy hitters are missing the mark, with ‘The Flash,’ ‘Aquaman 2,’ and ‘Shazam 2’ all performing well below expectations despite featuring some of their most popular characters

What about ‘Deadpool’? 'Deadpool & Wolverine' crushed it with $1.33B globally, and Sony's 'Venom' trilogy scored $1.83B, proving audiences aren't tired of superhero movies—they're just indifferent to B-list characters. The secret to success? Star power (Reynolds, Jackman, Hardy), smart marketing (like 'Deadpool's' R-rating), and characters people actually want to see, not just random villains who happened to fight Spider-Man once. Plus, 'Deadpool' isn't trying to force-launch another franchise—it's giving fans exactly what they've been begging for.

The Venom Effect: Here's the kicker—Sony could've actually used Spider-Man in any of these spinoff films ('Venom', 'Morbius', 'Madame Web', 'Kraven'). They just chose not to. 'Venom's' massive success seems to have convinced Sony they could turn any character from Spidey's world into box office gold, even without Spider-Man himself appearing. Spoiler alert: they can't.

Looking ahead... Sony's hitting what they're calling a "full reset mode" on Marvel properties. What does that mean? They're being way pickier about which ‘Spider-Man’ characters get their own movies, focusing on quality over quantity, and sharing more financial risk with partners (they even cut their stake in ‘Kraven’ from 75% to 50%). Meanwhile, their Tom Holland ‘Spider-Man’ films and animated Spider-Verse movies are still crushing it ($6.85B combined), showing audiences will still show up for the right project. The cape-and-tights bubble hasn't burst, but it's definitely sprung a leak.

WIDESHOT

🎬 Re-releases, data-hiding, and Korean shows…

(Source: Paramount Pictures)

🎬🔮 Legacy films are having their box office renaissance, with studios discovering fresh gold in wide theatrical reruns (100+ screens) of beloved movies, turbocharged by premium formats like IMAX and 4DX. Case in point: ‘Interstellar’ just sold out 166 IMAX screens a decade post-release, with tickets scalping for up to $300 a seat. As theaters face a post-pandemic, post-strike landscape with fewer tentpoles, expect to see more of these—there's clearly an appetite. Critics are already dream-casting the next wave of classics from ‘Pulp Fiction’ to ‘Gravity’ as candidates, predicting some megaplexes could serve as revival houses for older films. And many classics could tap entirely new fan bases: ‘Stop Making Sense’ proved this when 60% of its theatrical audience this year weren't even born for its 1984 debut. These aren't your indie cinema one-offs—they're premium event releases giving audiences an experience their living rooms can't touch. With low overhead on digital prints and built-in nostalgia appeal, legacy releases might be Hollywood's newest golden ticket.

📊🎬 Hollywood's favorite trick for hiding box office flops is about to disappear. Take Warner Bros.' ‘Juror #2’ and Searchlight's ‘Nightbitch’—both films played in dozens of theaters but were deliberately mislabeled as "Academy Runs" (typically just one-week, two-theater releases) to keep their real numbers under wraps. It's a trick that caught on in the streaming era, with Netflix making a habit of concealing box office data to keep underwhelming results under wraps. But starting Jan. 2025, that loophole closes: Comscore, the industry's premier tracking service, is telling studios they can't have their cake and eat it too. Right now, studios want Comscore to collect their data (beats calling every theater for numbers) while keeping it hidden from the public—but soon they'll have to choose: share the numbers or lose access themselves. For Comscore, whose bread and butter comes from subscribers paying premium rates for these stats, this game of data-hiding threatens their entire business model—after all, their service becomes less valuable every time a studio blocks its numbers. The new policy aims to protect that value proposition and prevent selective reporting from becoming the industry norm.

📺🌏 Netflix's Korean content gambit is reshaping streaming dynamics. Fresh Parrot Analytics data shows the streaming giant's bet on international content is paying off big time, with non-English releases hitting a record 50.5% of new shows in 2024, up from a modest 33.8% in 2020. The spotlight's on Korean content, which has more than doubled its slice of the pie to 6.7%, making it Netflix's third-biggest language after English and Spanish. Here's where it gets interesting: Netflix is pushing to break Korea's one-and-done TV tradition, pushing series like ‘Squid Game’ into second seasons despite only 29% of Korean shows typically going beyond season one. This global strategy is working wonders for subscriber retention, with surprisingly low churn rates across regions. The bigger picture? We're watching a shift where international content is becoming a main attraction for streaming, not just a nice-to-have addition.

INTERMISSION: A MESSAGE FROM THE DAILIES

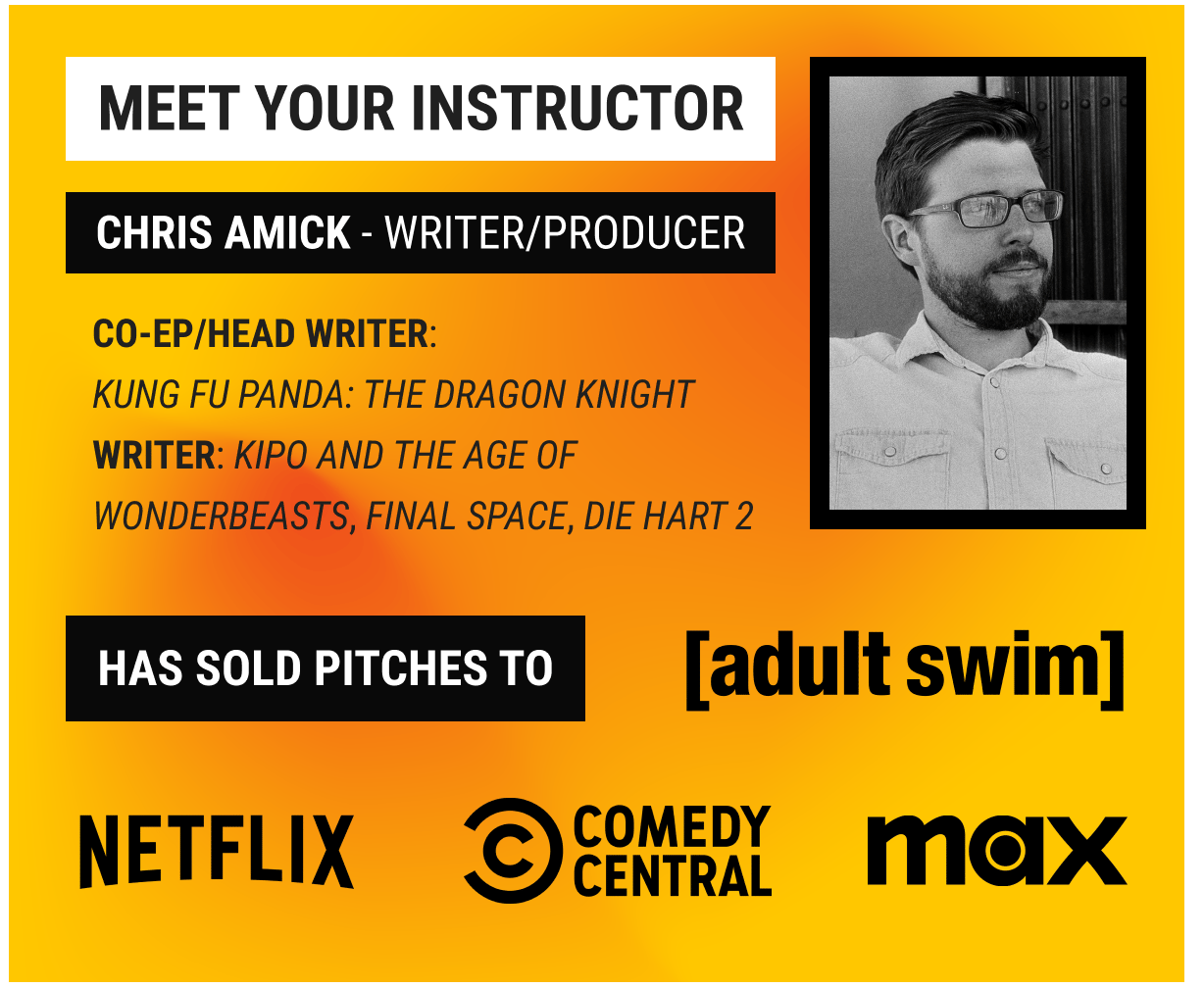

Turn your TV show idea into a winning pitch…

Struggling to pitch your TV show idea with confidence? This is the class for you.

The Dailies has teamed up with industry pro Chris Amick to bring you this exclusive 7-week course. You’ll get step-by-step guidance to craft a polished, market-ready pitch. Whether nerves or lack of experience hold you back, Chris’s proven process will give you the tools and confidence to succeed in any room.

📣 What Students Have Said:

"Chris breaks pitching down into simple steps, so you leave with a pitch you truly believe in." — Saundra H.

"Even the thought of pitching made my hands clammy. Chris gave us the tools to sell our work—and ourselves—in any room." — Jeremiah S.

"This class is a game-changer! Chris’s insights on pitching and the industry saved me years of trial and error." — Hannah K.

🗓️ Starts Jan. 16, 2025— Thursdays, 8–9:30 PM PT (recordings available)

💥 EARLY BIRD SPECIAL ENDS THIS WEEK!

This is your last chance to save $100—spots are filling up fast!

LAST LOOKS

Development 🗒️

Warner Bros. and MRC team up with Emerald Fennell, Margot Robbie, and Jacob Elordi for a fresh ‘Wuthering Heights’ adaptation, releasing Feb. 13, 2026. (more)

Anne Hathaway and Dave Bautista star in an untitled action-comedy about undercover agents posing as a couple, produced by the Russo brothers for Amazon MGM. (more)

‘Malcolm in the Middle’ returns with original stars Frankie Muniz, Bryan Cranston, and Jane Kaczmarek for a four-episode revival on Disney+. (more)

Jennifer Love Hewitt officially returns to the ‘I Know What You Did Last Summer‘ franchise, joining Freddie Prinze Jr. and new cast members for a July 2025 release. (more)

Owen Wilson joins Matt Rife in ‘Rolling Loud,’ an R-rated father-son comedy set at the iconic hip-hop festival, with production kicking off in Miami. (more)

HBO and Max are ending their deal for new ‘Sesame Street’ episodes, shifting focus away from kids’ programming while keeping the library on Max until 2027. (more)

Hayley Atwell is set to reprise her role as Agent Carter in ‘Avengers: Doomsday,’ directed by the Russo brothers and releasing May 1, 2026. (more)

Renewed & Canceled ✅ ❌

Other News 🚨

CALL SHEET

📅 The week ahead

MONDAY: SAG Awards nominations voting starts 🗳️

TUESDAY: Oscar shortlists announcement 👀

VIDEO VILLAGE

📺 Latest trailers

Aaaaand... that's a wrap! If you're reading this email because a friend hooked you up, don't fret—just hit that subscribe button and join the party. 📧👇

See you bright and early on Wednesday!

-The Dailies Team

Want to advertise with us? Get in touch today